How to Start Business in Saudi Arabia in 2025

How to Start Business in Saudi Arabia: Complete 2025 MISA Guide for Indian Entrepreneurs

Complete guide for Indian entrepreneurs to start business in Saudi Arabia 2025. MISA license, LLC setup, Vision 2030 opportunities, costs & compliance steps.

Saudi Arabia has emerged as the Top Investment Destination in the Middle East, offering unprecedented opportunities for Indian entrepreneurs seeking to capitalise on the Kingdom’s ambitious Vision 2030 transformation and start business in Saudi Arabia. The introduction of 100% Foreign Ownership KSA policies and streamlined MISA License 2025 processes have created an India-KSA Investment Corridor that promises substantial returns for forward-thinking business leaders. This comprehensive guide provides the definitive roadmap for Indian entrepreneurs to successfully establish and operate businesses in the world’s fastest-growing economy, where Giga-Projects Investment and renewable energy initiatives are reshaping the commercial landscape.

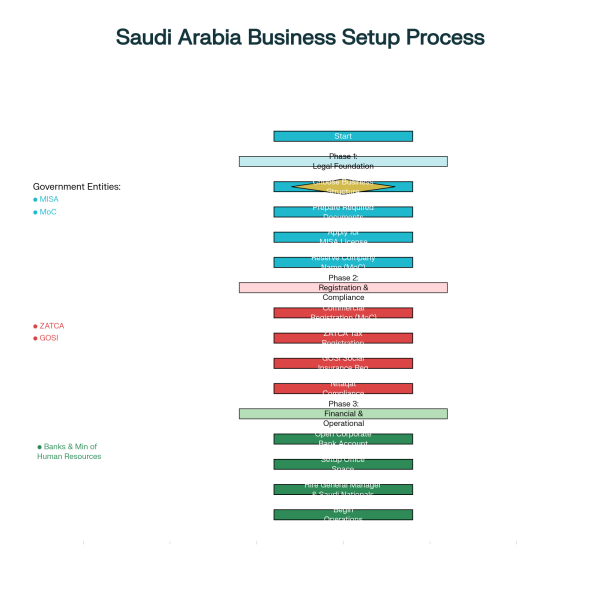

Phase 1: Legal Foundation – Building Your Business Framework

The journey to establishing a successful business in Saudi Arabia begins with understanding the critical legal structures and obtaining the mandatory MISA Registration Process. The Ministry of Investment of Saudi Arabia (MISA) serves as the primary gateway for foreign investors, offering streamlined digital services that have revolutionized the business setup experience.

Choosing Your Business Entity: LLC KSA vs. Branch Office

Limited Liability Company (LLC) represents the most popular choice for Indian entrepreneurs, offering operational flexibility and 100% Foreign Ownership KSA in most sectors. The LLC KSA Minimum Capital requirement typically ranges from SAR 500,000 for service sectors to higher amounts for specialised industries. This structure provides limited liability protection while allowing complete foreign control of operations.

Branch offices offer an alternative structure for companies with established operations in India, requiring lower initial capital but limiting operational scope to activities matching the parent company’s business. Indian Investor Legal Steps must carefully evaluate which structure aligns with their long-term expansion strategies and compliance capabilities.

The MISA License 2025 Registration Process

The MISA License 2025 process has been significantly digitised, reducing bureaucratic complexity while maintaining rigorous compliance standards. Foreign investors must prepare comprehensive documentation including authenticated Commercial Registration from India, audited financial statements, and Memorandum of Association. All documents require attestation by Saudi Embassy or Apostille Seal for countries under the Hague Convention.

The online application through MISA’s e-Services Portal typically processes applications within 5-7 business days, representing a dramatic improvement from previous timelines. Investment fees include SAR 12,000 initial registration plus annual renewal fees, establishing the foundation for all subsequent licensing activities.

Phase 2: Registration & Compliance – Navigating Government Requirements

Commercial Registration with Ministry of Commerce (MoC)

Commercial Registration MoC represents the cornerstone of legal business operations in Saudi Arabia. The Ministry of Commerce requires comprehensive business documentation, including reserved trade names, Articles of Association, and proof of capital adequacy. Registration costs typically range from SAR 1,200 to SAR 5,000 depending on business structure and location.

The MoC Portal facilitates name reservation, document authentication, and Commercial Registration issuance through integrated digital services. Business names must comply with Arabic language requirements and avoid restricted terminology that implies government affiliation.

ZATCA Tax Compliance and Registration

ZATCA Tax Compliance encompasses VAT registration, corporate tax obligations, and Zakat requirements for certain business structures. The Zakat, Tax and Customs Authority (ZATCA) mandates registration within 30 days of Commercial Registration issuance. Foreign-owned companies face Corporate Tax obligations while Saudi and GCC-owned entities contribute Zakat payments.

VAT Registration becomes mandatory when annual revenue exceeds SAR 375,000, though voluntary registration provides operational advantages for B2B transactions. ZATCA Registration enables access to government contracts, banking services, and establishes crucial credibility with local partners.

GOSI Social Insurance and Saudization Compliance

GOSI Registration ensures compliance with Saudi Arabia’s comprehensive social insurance system. Employers must register all employees within 30 days of hiring, contributing 11.75% of Saudi employee salaries while Saudi nationals contribute 9.75%. Non-Saudi employees require only 2% occupational hazard coverage from employers.

The Saudization Nitaqat Program requires strategic workforce planning to meet mandatory Saudi employment quotas. Companies with more than 10 employees must maintain specified Saudization percentages based on industry sector and company size. Nitaqat compliance affects visa processing, government contract eligibility, and operational permits.

Phase 3: Financial & Operational Setup

Corporate Bank Account Requirements for Foreign Companies

If you are going to start business in Saudi Arabia, in 3rd phase you need to open and for Opening a Corporate Bank Account KSA for Foreigners requires comprehensive documentation and minimum capital deposits. Saudi banks typically require SAR 25,000 minimum balance for foreign-owned accounts, though requirements vary by institution and business sector. Required documentation includes MISA License, Commercial Registration, VAT Certificate, and General Manager’s Iqama.

Parent Company Documentation must include attested Commercial License, ownership structure charts, and beneficial owner identification. The account opening process typically requires 2-3 weeks once all documentation is submitted.

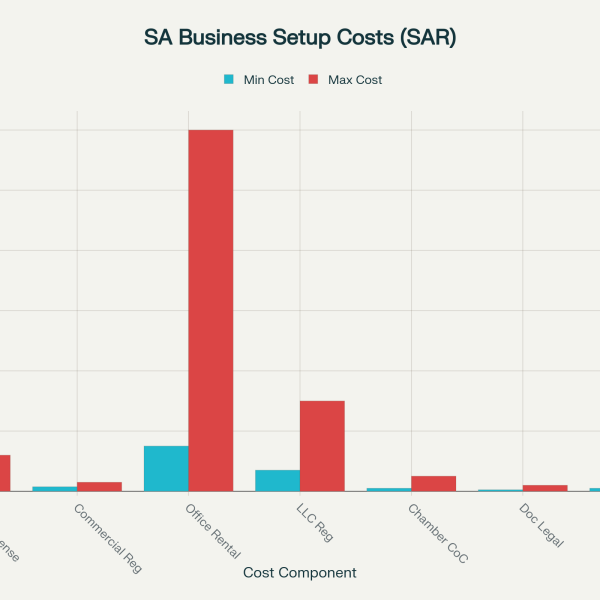

Business Setup Cost KSA Analysis

Business Setup Cost KSA for Indian entrepreneurs typically ranges from SAR 50,000 to SAR 150,000 in the first year. Incorporation costs average SAR 150,000 including professional services, while hiring costs for General Manager and Saudi nationals add approximately SAR 375,000 annually. Office Space Requirements vary from SAR 20,000 for shared workspaces to SAR 120,000 for premium locations.

Compliance and renewal costs reach approximately SAR 75,000 annually, including license renewals and government portal maintenance. These investments establish the foundation for sustainable operations and regulatory compliance throughout the business lifecycle.

Mega Opportunities in 2025: Capitalizing on Vision 2030 Growth Sectors

NEOM Investment and Giga-Projects

NEOM Investment opportunities represent the world’s largest urban development project, with $500 billion committed to creating a futuristic city powered entirely by renewable energy. The NEOM project offers special tax and regulatory frameworks enabling foreign companies to participate in groundbreaking infrastructure development. THE LINE megacity alone expects to create 380,000 new job opportunities, while the broader NEOM ecosystem targets $48 billion GDP contribution by 2030.

Must Read: Avoid the Most Common Business Failures in 2024

Giga-Projects Investment extends beyond NEOM to include Red Sea Global, AMAALA, and Qiddiya entertainment destinations. These projects prioritize sustainability, technology integration, and 100% renewable energy operations. The NEOM Investment Office actively seeks private partnerships across infrastructure, real estate, energy, and technology sectors.

KSA Renewable Energy Sector Expansion

KSA Renewable Energy Sector growth represents one of the world’s most aggressive clean energy transitions, targeting 50% renewable electricity generation by 2030. Saudi Arabia committed $8.3 billion to develop 15,000 MW of wind and solar capacity through ACWA Power and consortium partners. The National Renewable Energy Programme (NREP) plans to install 58.7 GW of renewable capacity, creating massive opportunities for international suppliers and service providers.

Green hydrogen production offers particular promise, with NEOM Green Hydrogen Project representing the world’s largest facility producing 600 tons daily. The Yanbu Green Hydrogen Hub will nearly double this capacity by 2030, positioning Saudi Arabia as a global green hydrogen export leader.

Fintech and AI Opportunities in Saudi Arabia

Fintech and AI Opportunities Saudi Arabia have experienced explosive growth, with the Saudi fintech market projected to reach $1.5 billion by 2025 and $144.11 billion by 2034. The Kingdom attracted $860 million in VC funding during the first half of 2025, representing 56% of all MENA capital. Over 260 licensed fintech players now operate in the Kingdom, surpassing 2025 targets a full year ahead of schedule.

Artificial Intelligence investment reaches $1.073 billion in 2024, projected to grow to $4.018 billion by 2033 at 15.80% CAGR. The Saudi Company for Artificial Intelligence (SCAI) under Public Investment Fund drives national AI transformation across healthcare, education, energy, and public services. If you want to start business in Saudi Arabia you have to know that, the Vision 2030 targets positioning Saudi Arabia among the top 15 nations globally for AI readiness while creating 20,000 jobs in data and AI.

Conclusion & Next Steps

Start Business in Saudi Arabia represents an unprecedented opportunity for Indian entrepreneurs to participate in one of history’s most ambitious economic transformations. The Kingdom’s Vision 2030 has created a business-friendly ecosystem where 100% Foreign Ownership, streamlined MISA licensing, and massive Giga-Projects Investment combine to offer exceptional returns for early movers.

Success requires careful navigation of the three-phase setup process: securing MISA licenses and choosing appropriate business structures; completing MoC, ZATCA, and GOSI registrations while planning Nitaqat compliance; and establishing financial operations through corporate banking and office setup. The total investment of SAR 50,000-150,000 provides access to a $833 billion economy with 50% GDP growth targets by 2030.

The convergence of renewable energy expansion, fintech innovation, and AI advancement creates sector-specific opportunities that align perfectly with India’s technological expertise and entrepreneurial capabilities. Indian Owner KSA success stories will emerge from those who combine strategic planning with rapid execution in this dynamic market environment.

Indian entrepreneurs ready to capitalise on this Saudi Arabia Vision 2030 opportunity should begin the MISA registration process immediately while conducting detailed market analysis of their target sectors. The Listunite will work as India-KSA Investment Corridor to offers a pathway to regional market access if you want to start business in Saudi Arabia, sustainable growth, and participation in the global economy’s most exciting transformation story.

If you have any suggestion or want to share anything please comment.

For latest updates follow on social media, Facebook, Instagram, X, LinkedIn, Youtube.